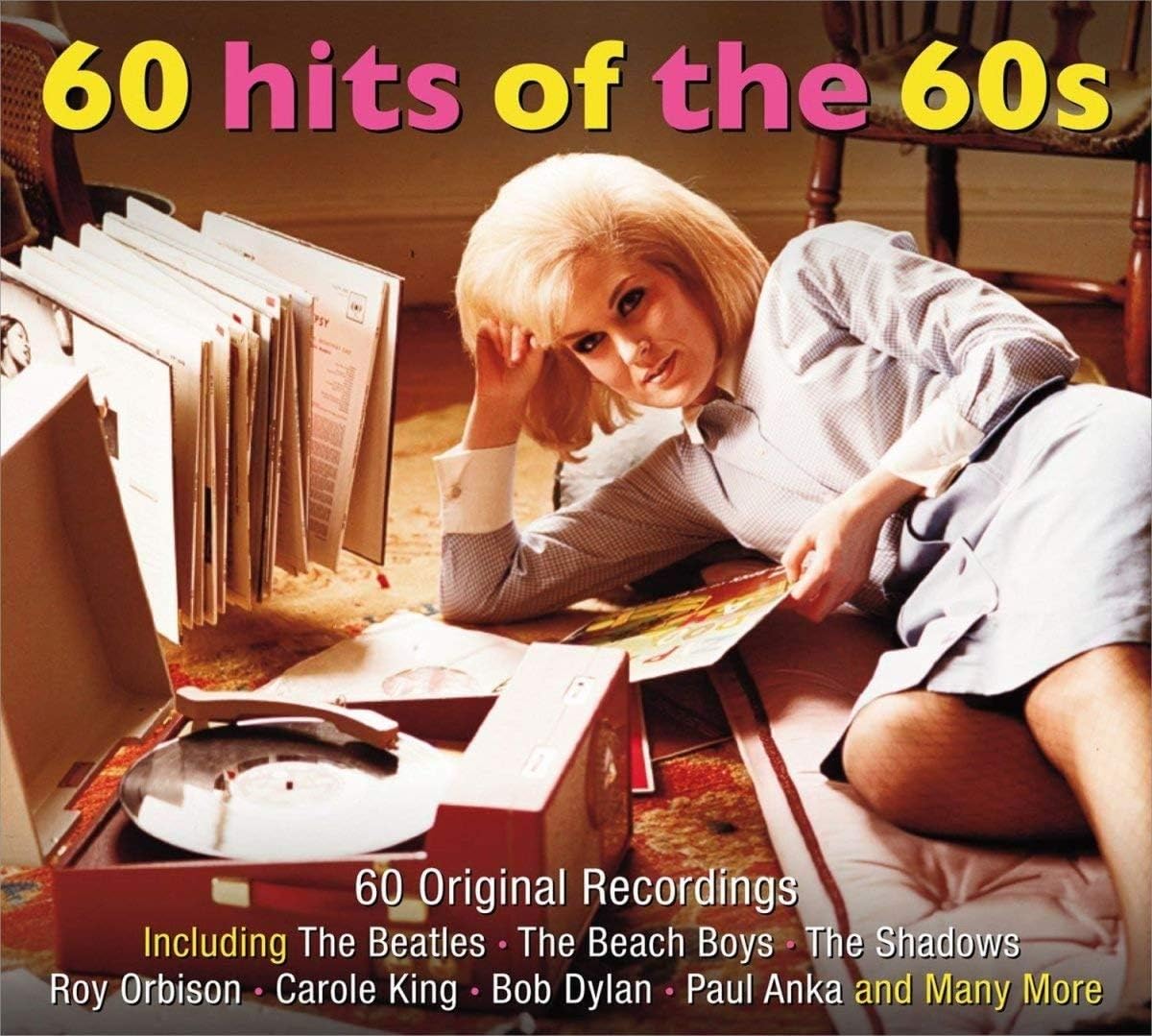

60 Hits Of The 60s

- Brand: Unbranded

Description

Certificates of deposit are time deposit accounts. They earn a fixed rate of interest on the money you invest for a fixed period of time. Unlike a savings account, CDs generally don’t allow you to withdraw the principal at any time during the term. If you withdraw money before the maturity date, you’ll often pay an early withdrawal penalty fee. How Do CDs Work? Term: Your time horizon is a significant factor in the CD account you choose. CDs are time deposit accounts. Align the CD’s term with when you’ll need access to your money. If you’re interested in using a CD laddering strategy (see below), look for a bank or credit union that carries terms that can help you reach that goal. APY: The best CDs offer annual percentage yields that keep your money safely growing while meeting your savings goals.

CDs can be a useful way to grow savings for the short- and long-term. When opening CD accounts, it’s helpful to know how to make the most of those deposits.On the other hand, you could choose to allocate them for different amounts, with the highest balance earning the highest APY. For example, something like this: Early withdrawal penalty: Banks charge an early withdrawal penalty for withdrawing money before a CD term ends. Early withdrawal penalties vary and may be a flat fee, such as 30 days of interest, or a percentage of the interest earned on the account so far. Banks may also base the fee on your CD term length. No-penalty CDs do not charge this fee. Minimum deposit: Requirements for minimum deposits vary by bank and credit union. Decide what you can realistically deposit before opening an account.

While seeking out the best rate can be a driving goal for someone purchasing a CD, individuals may want to consider building a long-term relationship with a bank that aligns with their values,” says Jen Mayer, Accredited Financial Counselor and founder of Fully Funded. “For instance, if someone is building a CD ladder and planning to spend years with an institution, choosing a bank or credit union where a relationship with a banker can be established could be beneficial.” CD Fees Similar to a bump-up CD, a step-up CD raises your CD rate, but at predetermined intervals throughout the term. Daniel O’Donnell’s recording career has now spanned 35 years and he continues to delight fans around the world by his recording and touring activities. CD accounts are best for savers on fixed incomes who have funds they won’t need to access over the course of a CD term. Because CD terms can vary, the risk of needing to access funds increases as term lengths increase. CDs are also a great option for individuals who want to earn a higher, guaranteed interest rate.You can usually open a certificate of deposit online or in person at banks or credit unions. Follow the steps below to buy a CD. Divide your initial deposit: Determine how much money you want to invest in CD accounts. Divide the total amount up by the number of CD accounts you plan to open. Another important consideration with certificates and CDs is the likelihood of having to pay an early withdrawal penalty if you withdraw your funds before the stated maturity date. As one of the CDs matures, the money, for example, may be reinvested in a new five-year CD. Eventually, you would have a five-year CD maturing each year. This will enable you to have some access to your money and, at the same time, keep it in a higher-yielding savings vehicle.

CDs may not provide a double-digit return right now, but you can get a higher rate if you are willing to shop around. Thanks to the increased competition in the marketplace, consumers have many options from traditional banks and their online brethren. During his career, in the United Kingdom Daniel has amassed forty-six Top 75 albums, including eighteen Top 10 albums, with sixteen of them this Century, a feat not achieved by any other recording Artist.Daniel is the UK chart’s most prolific and one of the most successful recording Artists. In 2020, he broke his own world record, by becoming the first recording artist to chart at least one new album every year in the Artist Albums Chart for 33 consecutive years. Reinvest your funds: As your CDs reach maturity, decide whether to withdraw your savings or reinvest your money into new CDs to continue your ladder. Withdrawal penalties: Most CDs require you to keep your money in the account until the end of the CD term. Withdrawing your funds before then could mean that you’ll pay an early withdrawal fee, eating up the interest earned by the account.

Banks and credit unions offer CDs in a wide range of terms and types. While APY may be the main factor in play when shopping for a CD, there are other factors to consider as well. Here’s what to keep in mind when choosing a CD:Early withdrawal penalty: You’ll generally have to pay an early withdrawal penalty if you need access to the money in your CD before its maturity date. These penalties vary by institution and term, but they can often be costly—eating up interest earned and occasionally some of your principal investment. Compounding schedule: The faster your interest compounds, the more money you earn. Look for a CD that compounds daily. Customer experience: Should a question or problem arise, the institution’s customer service department should be reachable, helpful and responsive. Unlike other deposit accounts, banks don’t charge monthly maintenance fees for CDs. However, withdrawing your funds prematurely may result in one of the following fees.

- Fruugo ID: 258392218-563234582

- EAN: 764486781913

-

Sold by: Fruugo